THE RETIREMENT DECEPTION

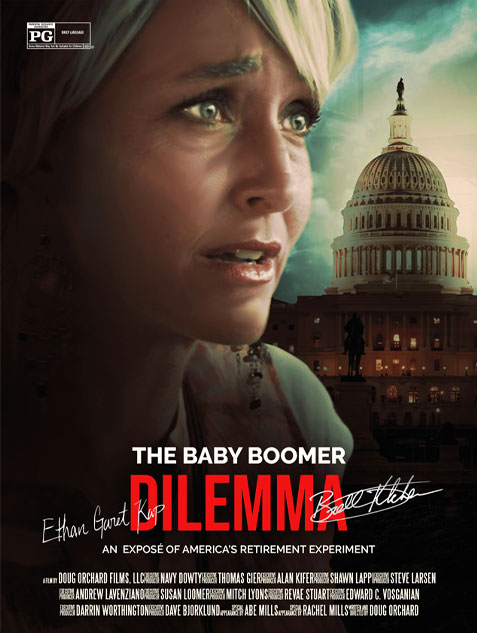

THE AWARD WINNING FILM

During filming, Brett Kitchen and Ethan Kap criss-crossed the country, traveling over 20,000 miles. They visited dozens of cities, ate countless steak fajitas, and interviewed dozen of retirees seeking the answer to 1 question:

What Is Retirement Success?

What Brett and Ethan found may surprise you. It’s not about having the biggest nest egg. It’s not about the rate of return on your money, or what your net worth statement shows. In fact, retirement success can be summed up in 2 words: Lifestyle Lock.

The retiree’s who have their lifestyles locked in, guaranteed for life, are the ones who are happiest, most stress free, and enjoy their lives to the fullest.

REQUEST YOUR COPY OF THE FILM